Office Time

Mon-Sat: 8am to 8pm

Setup your company in UAE / Dubai mainland & Free zone with 100% foreign ownership, Get full ownership for your commercial company registered in UAE, Oman & KSA

Save time, money & energy by outsourcing to experts. We are a business set up company helping locals and expats to incorporate companies in The Emirates and other Middle East Regions.

To that purpose, we are driven to come up with solutions to get start-ups started quickly, inexpensively and hassle free. We provide the most optimum solution suiting a client’s requirement.

These entities can perform different business activities in the local market subject to government approvals.

Read more

Company in DMCC, DWC, SAIF Zone, Knowledge Park, Health care city, Academic city, Silicon Oasis ..

Read moreUAE, Oman, KSA, Bahrain, UK, Hong Kong, Mauritius, Seychelles...

Corporate, Employment, Investor, employee & Golden Visa

Residents, foreign expatriates & their families to come to work, live & study

Let us handle it so you can focus on business.

Comprehensive outsourced Payroll Management & processing

Brand protection, Drafting, Filing & submission.

Simplify business setup with expert guidance on UAE company formation for limitless growth and opportunities.

GST QUOTEStreamline your Oman company registration process with expert assistance for seamless setup and business success.

GET QUOTESimplify Saudi business setup with professional guidance, ensuring efficient processes and unlocking growth opportunities effortlessly.

GST QUOTEExperience hassle-free Bahrain company incorporation with expert support, ensuring smooth setup and business growth opportunities.

GST QUOTEThrive in the tax-free zones of the Dubai, Ajman, Abu Dhabi, Rak ..

EXPLORENavigating UAE's corporate law is easier with our professional legal services.

EXPLORESimplify UAE government procedures with our efficient and reliable PRO services.

EXPLOREEnsure compliance and financial clarity with our comprehensive VAT & accounting

EXPLOREEfficiently navigate the liquidation process in the UAE with our expert services.

EXPLOREStreamline administrative tasks with our expert secretarial services in the UAE.

EXPLOREProtect your brand with our trusted trademark registration services in the UAE.

EXPLOREPrivate office, Co working space, meeting room or flexi desk at affordable cost.

EXPLOREIt allows the dependent family members of a UAE resident to live & work in UAE.

EXPLOREOptimize pricing strategies with expert consulting for business growth.

EXPLORERefine operations with expert consulting for effective business operation plans.

EXPLOREStrategic guidance for business success through expert consulting services.

EXPLORE

To serve you better, we work close with all government agency to make the work done at right time.

POSTED BY

POSTED BY

POSTED BY

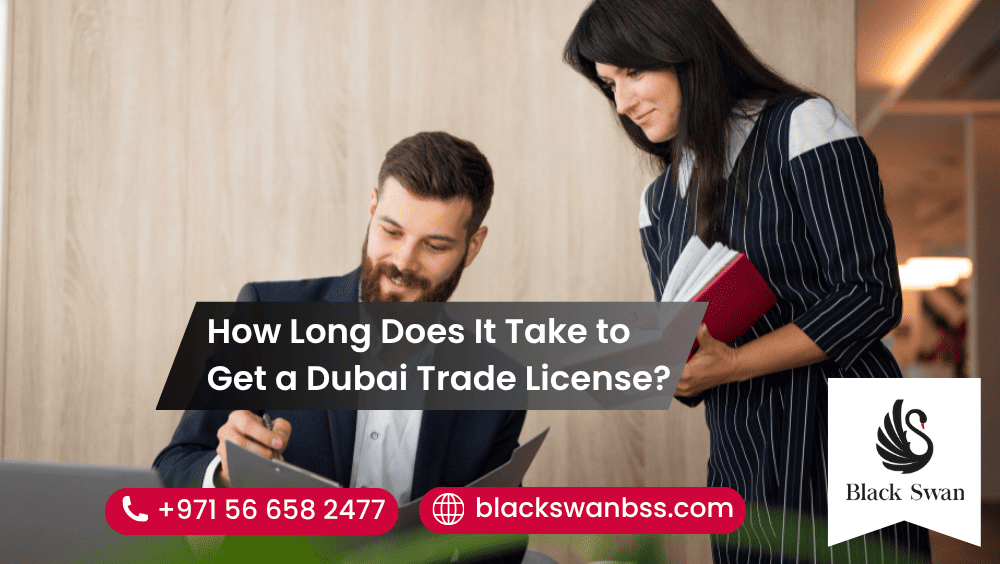

In Dubai, businesses can be established as sole proprietorships, partnerships, limited liability companies (LLCs), or branches of foreign companies.

The process typically involves selecting a business activity, choosing a company name, obtaining initial approvals, drafting legal documents, and registering with the relevant authorities.

Dubai offers numerous advantages such as strategic location, tax benefits, access to a diverse market, world-class infrastructure, and a business-friendly environment.

Legal requirements include obtaining necessary licenses and permits, adhering to local regulations, fulfilling visa requirements for employees, and complying with tax obligations.

The minimum capital requirement varies depending on the type of business entity and the business activity chosen.

While certain business activities require local sponsorship or a partnership with a UAE national, there are free zones in Dubai where 100% foreign ownership is permitted.

Costs may include registration fees, license fees, office space rental, visa fees, and other miscellaneous expenses.

Free zones offer 100% foreign ownership, tax exemptions, repatriation of profits, simplified customs procedures, and access to state-of-the-art infrastructure.

The timeline for setting up a business in Dubai can vary depending on factors such as the type of business entity chosen, completion of documentation, and approvals from relevant authorities.

Dubai offers a range of support services including business consultancy, legal assistance, banking services, networking opportunities, and access to government initiatives aimed at fostering business growth.

Ensure you choose the top experts for your business setup in the UAE, Oman, KSA & Bahrain. With Blackswan, you’ll accelerate your journey to success.